Rep. Chris Collins is in major hot water, according to a

recently unsealed 10-count, 30-page indictment from the U.S. Attorney for the

Southern District of New York. Allegedly, Collins, from an upstate New York district near Buffalo, tipped off his son to inside information

before it was publicly disclosed about the failed drug trial of an Australian

biotech company’s only drug with any prospects of success.

Ironically, or sadly, or pathetically or outrageously, or all of the aforementioned, Collins was at the time the largest shareholder and a board member of the company, Innate Immunotheraputics Limited. He was also on a subcommittee of the Energy and Commerce Committee that oversees the healthcare and drug industries and had been under investigation for months by the Congressional Ethics Office as a result of serving on the company's board and promoting its prospects. To make matters worse, he allegedly lied to the FBI about the whole thing.

Ironically, or sadly, or pathetically or outrageously, or all of the aforementioned, Collins was at the time the largest shareholder and a board member of the company, Innate Immunotheraputics Limited. He was also on a subcommittee of the Energy and Commerce Committee that oversees the healthcare and drug industries and had been under investigation for months by the Congressional Ethics Office as a result of serving on the company's board and promoting its prospects. To make matters worse, he allegedly lied to the FBI about the whole thing.

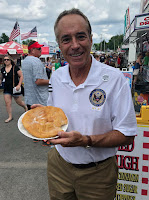

Whew. If all this is true, Collins is about the biggest nincompoop in Washington. (Well, maybe the second biggest.) That’s a photo of Collins at left from his Facebook page, showing him at a recent constituent event holding a plate of fried dough. Fried dough is exactly what he’ll be if the U.S. Attorney has the goods on him. And it sounds like it does.

The indictment says that after Collins’ tip his son, Cameron, sold almost 1.4 million shares of Innate in 54 trades starting the next morning, avoiding some $570,000 of losses he otherwise would have incurred when the stock tanked over 92% the day the failed drug trial was announced. Cameron is also under indictment for passing on the insider info to his fiancé’s father, Stephen Zarsky, his fiancé and other of their relatives and friends, who also sold their stock and avoided close to $200,000 in losses.

All that is documented in the indictment by emails, texts, phone records and stock trading data. That includes the email Collins got from Innate’s CEO saying the drug failed the trial while Collins was on the South Lawn of the White House attending the annual Congressional Picnic. It includes Collins’ email back saying, “Wow. How are these results even possible???” It also includes records of Collins’ frantic seven phone calls to Cameron, in the last of which he finally got through to him. Also the substance of a phone call from Zarsky to one of his tippees, a longstanding friend in which he said Cameron intended to buy a house so he would have an ostensible excuse for the timing of his trades if he were ever asked about them (Cameron is also indicted for lying to the FBI). Ditto a press release Collins had his staff release, stating that Cameron sold his stock only after a halt on its trading had been lifted, and at “substantial financial loss.”

Collins & Son and Zarsky are all named in the indictment that alludes to six other unindicted co-conspirators (Zarsky’s wife, daughter, two brothers and that longstanding friend, and a friend of Cameron and his fiancé). I stress unindicted, because if the U.S. Attorney’s previous modus operandi—and that of any other methodical prosecutor—is any guide, it started at the bottom and got the six minnows to flip by squeezing them into ratting out the bigger fish.

One of my first

novels, Bull Street, is about an insider trading

ring, and I never would have put a character in it who behaved as idiotically

as Collins is alleged to because nobody would believe it.

A few years ago I wrote a blog entitled You Can't Make This Stuff Up on the psychology of insider traders based on my experience on Wall Street. They seem to have no shame or no memory of previous convictions for the crime. The practice will go on forever.

And they’ll keep getting caught. The U.S. Attorney for the Southern district of New York has a winning record in getting convictions for insider trading. They’re the guys who sent Ivan Boesky, Marty Siegel, Dennis Levine and Mike Milken to jail in the 1980s. Preet Bharara, the previous U.S. Attorney for the Southern District of New York, won over 85 insider trading cases in a row at one point. They don’t go to a grand jury unless they’ve got the goods. Collins’ tip to his son occurred over a year ago, the FBI took until April of this year to interview Collins & Son and Zarsky, and the U.S. Attorney until now to indict them. They’re efficient, systematic and relentless. Usually when they surface, where there’s smoke there’s fire.

In the few days since his indictment, Collins has been kicked off the Energy and Commerce Committee and suspended his re-election campaign for his House seat in November. “Meritless,” is what Collins has called the charges. We’ll see. Unless Collins has redefined the word.

He may also have redefined the word “nincompoopery.”

A few years ago I wrote a blog entitled You Can't Make This Stuff Up on the psychology of insider traders based on my experience on Wall Street. They seem to have no shame or no memory of previous convictions for the crime. The practice will go on forever.

And they’ll keep getting caught. The U.S. Attorney for the Southern district of New York has a winning record in getting convictions for insider trading. They’re the guys who sent Ivan Boesky, Marty Siegel, Dennis Levine and Mike Milken to jail in the 1980s. Preet Bharara, the previous U.S. Attorney for the Southern District of New York, won over 85 insider trading cases in a row at one point. They don’t go to a grand jury unless they’ve got the goods. Collins’ tip to his son occurred over a year ago, the FBI took until April of this year to interview Collins & Son and Zarsky, and the U.S. Attorney until now to indict them. They’re efficient, systematic and relentless. Usually when they surface, where there’s smoke there’s fire.

In the few days since his indictment, Collins has been kicked off the Energy and Commerce Committee and suspended his re-election campaign for his House seat in November. “Meritless,” is what Collins has called the charges. We’ll see. Unless Collins has redefined the word.

He may also have redefined the word “nincompoopery.”